Hey Quant X,

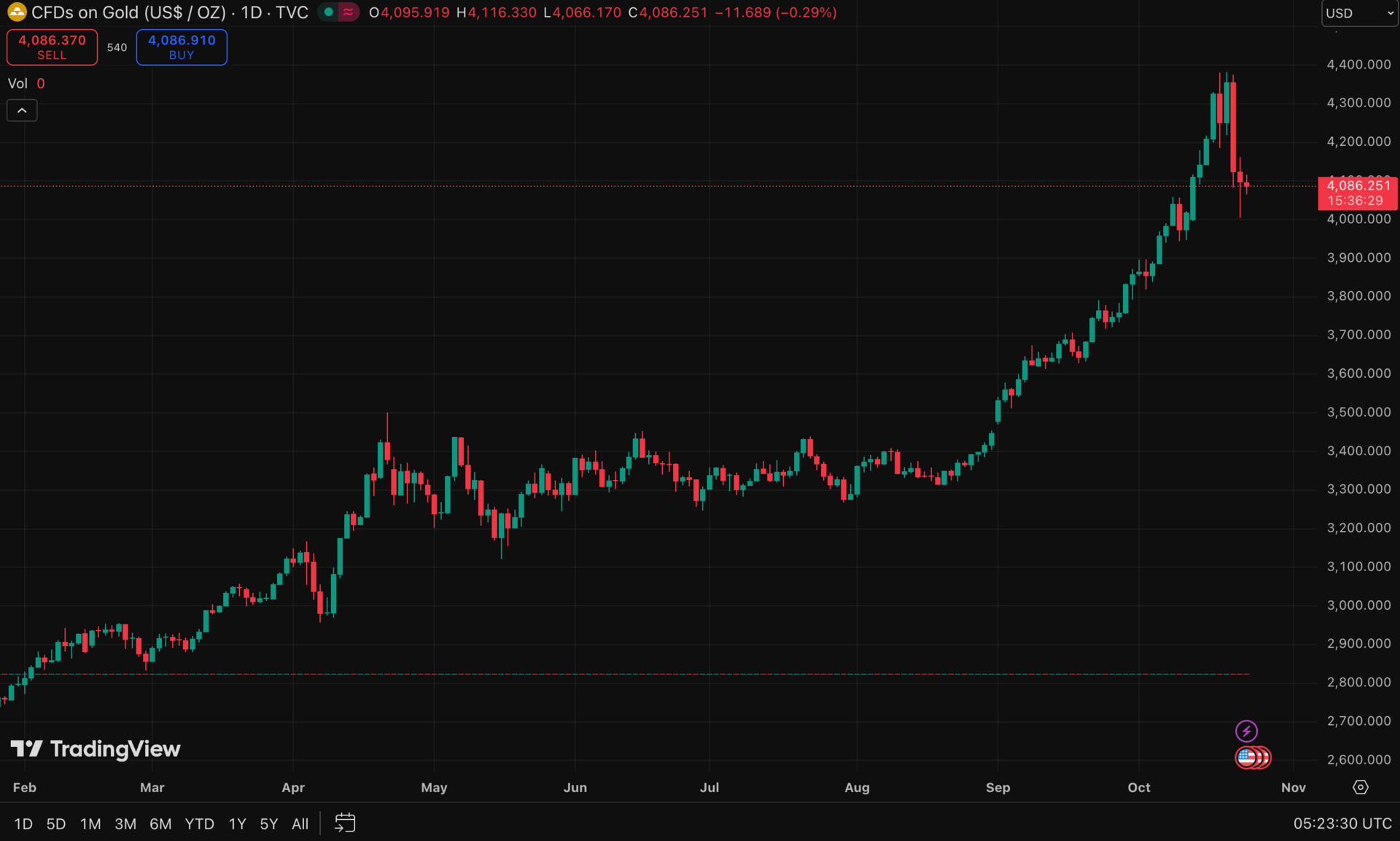

This week, gold did something it hasn't done in over 12 years: it plunged over 5% in a single day, retreating from record highs above $4,300 to around $4,100.

On the surface, the reasons seem clear: easing U.S.-China trade tensions and a firming U.S. dollar have prompted a wave of profit-taking. But for quants, a price drop this severe isn't just noise, it's a signal.

It forces a critical question: is this the end of the historic rally or a classic shake-out before the next leg up?

The answer lies not in the headlines, but in the historical pattern of what ALWAYS happens when fear, liquidity and gold collide.

📉 The Panic Playbook: A History of Havens

When markets wobble, investors flee to safety but the path to gold is never a straight line. Our analysis of the last 50 years reveals a crucial, counter-intuitive rhythm:

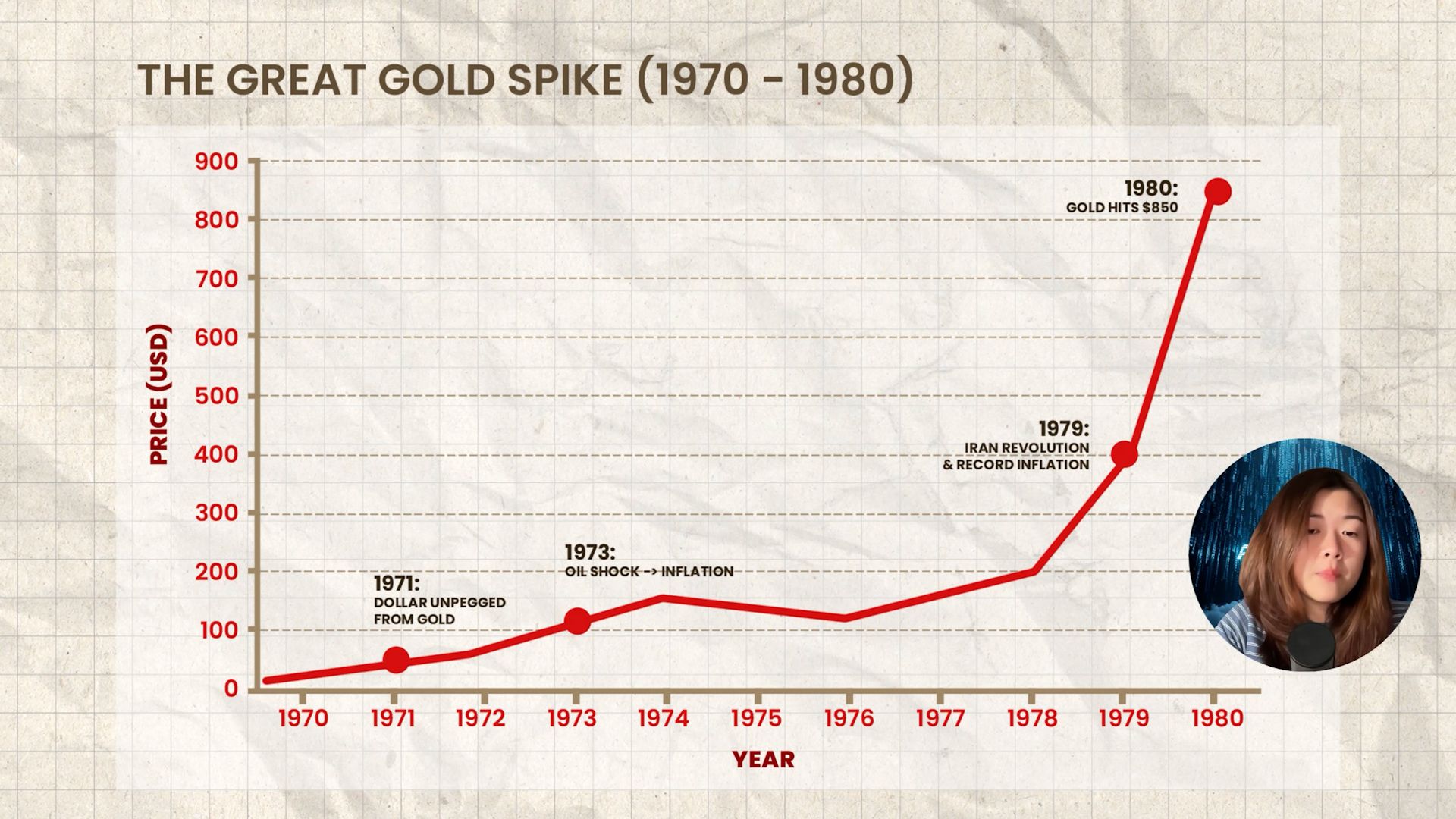

The 1970s Stagflation: Amid monetary chaos, gold exploded from $35 to $850. It was the ultimate hedge against a system losing faith in itself.

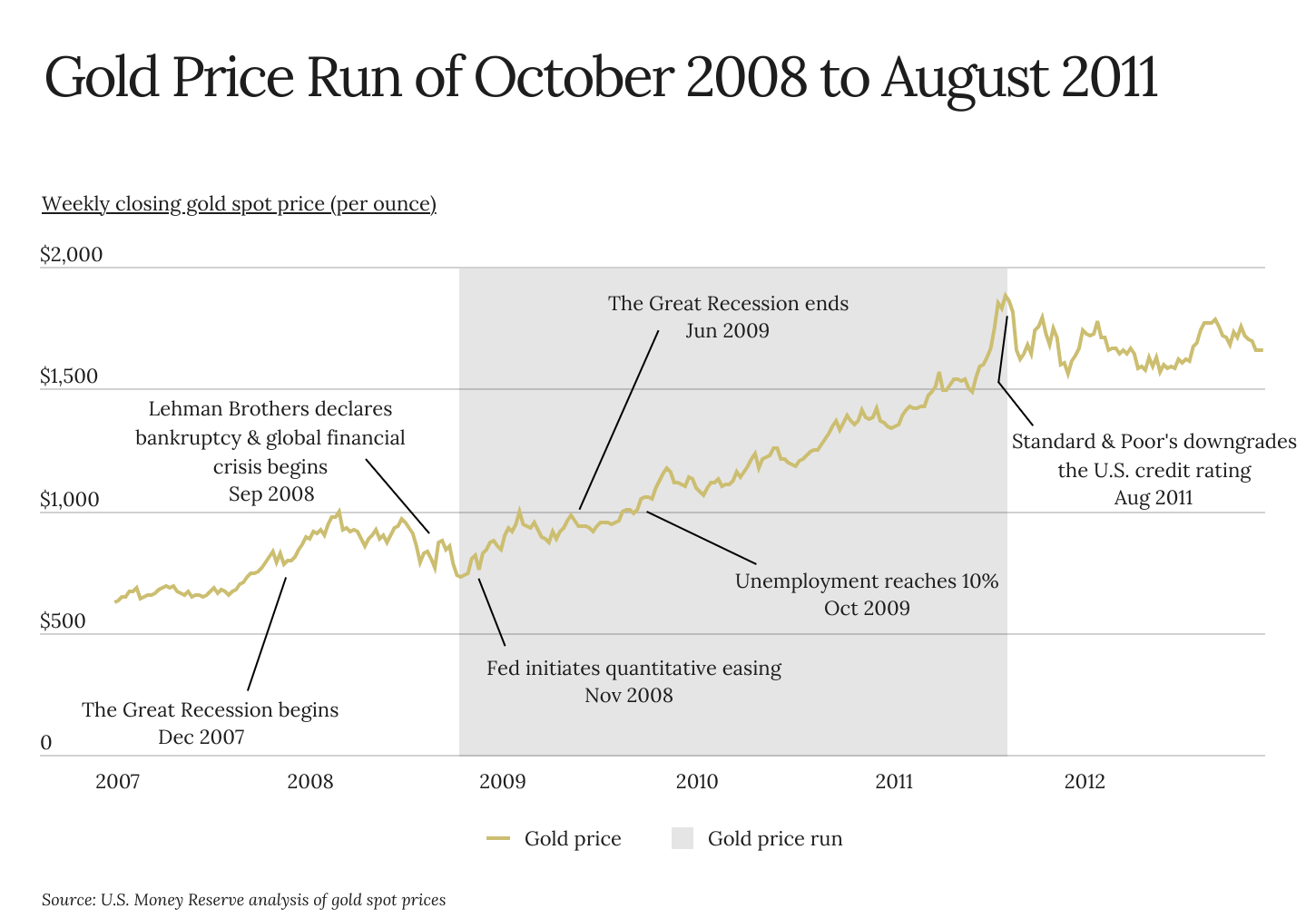

The 2008 Crisis: In the initial liquidity crunch, gold fell nearly 30% as everyone sold everything for cash. But once central banks flooded the system, it ignited a multi-year bull run, soaring over 170%. This was "The Great Flip" where gold's modern hedge status was forged.

The 2020 COVID Crash: Gold dipped initially, then snapped back to new highs within weeks, outperforming many risk assets. It acted as a stability anchor while other assets cratered.

The pattern is clear: In a major panic, gold might initially dip, but it consistently leads the recovery. The current pullback fits perfectly into this historical script.

🧠 The Psychology of Panic: Why We Flee to Gold

This behaviour isn't random; it's rooted in deep-seated psychology. When loss aversion kicks in, the pain of potential loss outweighs the joy of gain. We don't just flee to cash; we flee to trust.

Gold represents zero counterparty risk. It’s not a promise to pay; it’s a tangible store of value with millennia of credibility. In a digital age of complex debt, gold is simplicity. It feels safe. In a panic, that feeling is priceless.

🔍 The Quant's Edge: Reading the Signals, Not the Headlines

So, is gold's surge over? The underlying data suggests otherwise. This dip is happening against a backdrop of:

Historic Central Bank Buying: Creating a constant "bid" underneath the market.

Rate Cut Bets: The Fed is expected to cut rates, slashing the opportunity cost of holding gold.

A Mountain of Debt & Geopolitical Fear: The core drivers of the "uncertainty premium" haven't vanished.

Quants don't predict the news, but we measure the market's stress response. The current volatility isn't a death knell; it's a data point. The key is knowing how to use this information to protect and grow your wealth.

We’ve broken down the complete quantitative playbook.

In our latest video, you’ll learn:

The 3-phase pattern gold follows in every crisis.

How to structure your portfolio with gold as a strategic tool, not just insurance.

The simple rules for knowing when to rebalance and seize opportunity from volatility.

Subscribe to our channel for weekly data-driven breakdowns and join our Quant X Community where we read markets through math and data.

Stop reacting to price swings and start understanding the system. History doesn't repeat, but it rhymes and the rhyme is in the data.

Data is King.

Sizing is Everything.

Team Quant X

⚠️ Disclaimer: The content shared is for educational purposes only and reflects personal opinions. It should not be taken as financial or investment advice. Always do your own due diligence before making financial decisions. We do not PM anyone.