Hi Tribe,

If you’ve looked at your portfolio this week, you might be wondering if Santa skipped Wall Street this year. The S&P 500 and Nasdaq have posted back to back losses, reversing early December gains. The narrative was supposed to be simple: Fed cuts rates, stocks go up.

But here is the reality check: The market doesn’t care about the calendar; it cares about data.

With the Federal Reserve signalling a slower pace for future cuts and tech giants like Oracle stumbling on earnings, the easy money trade has stalled. Does this mean the rally is dead? Not necessarily. But blind optimism is a strategy for amateurs.

Today, we break down why the "Santa Rally" hasn't actually started yet, where the real alpha is hiding (hint: it's not in AI right now), and how to position yourself for the final trading days of 2025.

📅 Timing is Everything: The "Real" Rally Window

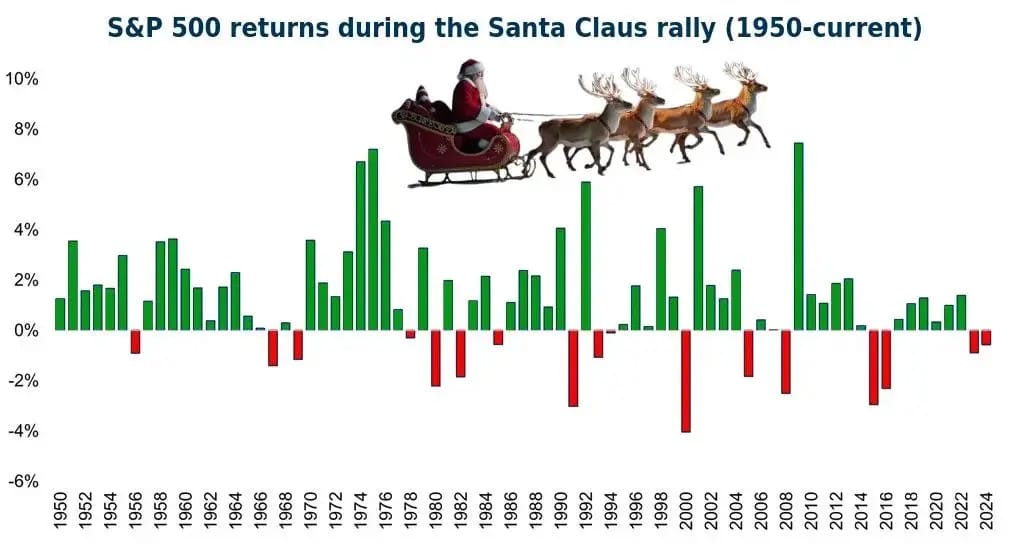

First, let’s clear up a misconception that costs traders money every year. A "Santa Claus Rally" isn’t just a generally good December. It is a specific statistical phenomenon defined as the last five trading days of the year plus the first two of the new year.

We aren’t in that window yet.

Historically, since 1950, the S&P 500 has posted positive returns during this specific 7-day period almost 80% of the time, with an average gain of 1.3%. So, if you are panicking because the market is red in mid-December, you are misreading the seasonal chart. The probability is still in your favor, but patience is the prerequisite.

🏦 The Fed Disconnect: Why Risk Sentiment is Struggling

Why is the market sputtering right now? It comes down to a mismatch in expectations.

While the Fed delivered the expected rate cut to 3.50%-3.75% and stopped quantitative tightening, the forward guidance was a cold shower. The Fed’s median forecast calls for just one rate cut in 2026, while the market was aggressively pricing in significantly more.

When the market realizes it's "wrong," it reprices. We are seeing that volatility now. Smart traders are watching the upcoming labor data closely, specifically the nonfarm payrolls, because if the jobs market shows cracks, the Fed may be forced to pivot again.

📉 Tech Stumbles vs 🥇 Commodities Shine

While the S&P 500 struggles, a massive rotation is happening under the surface.

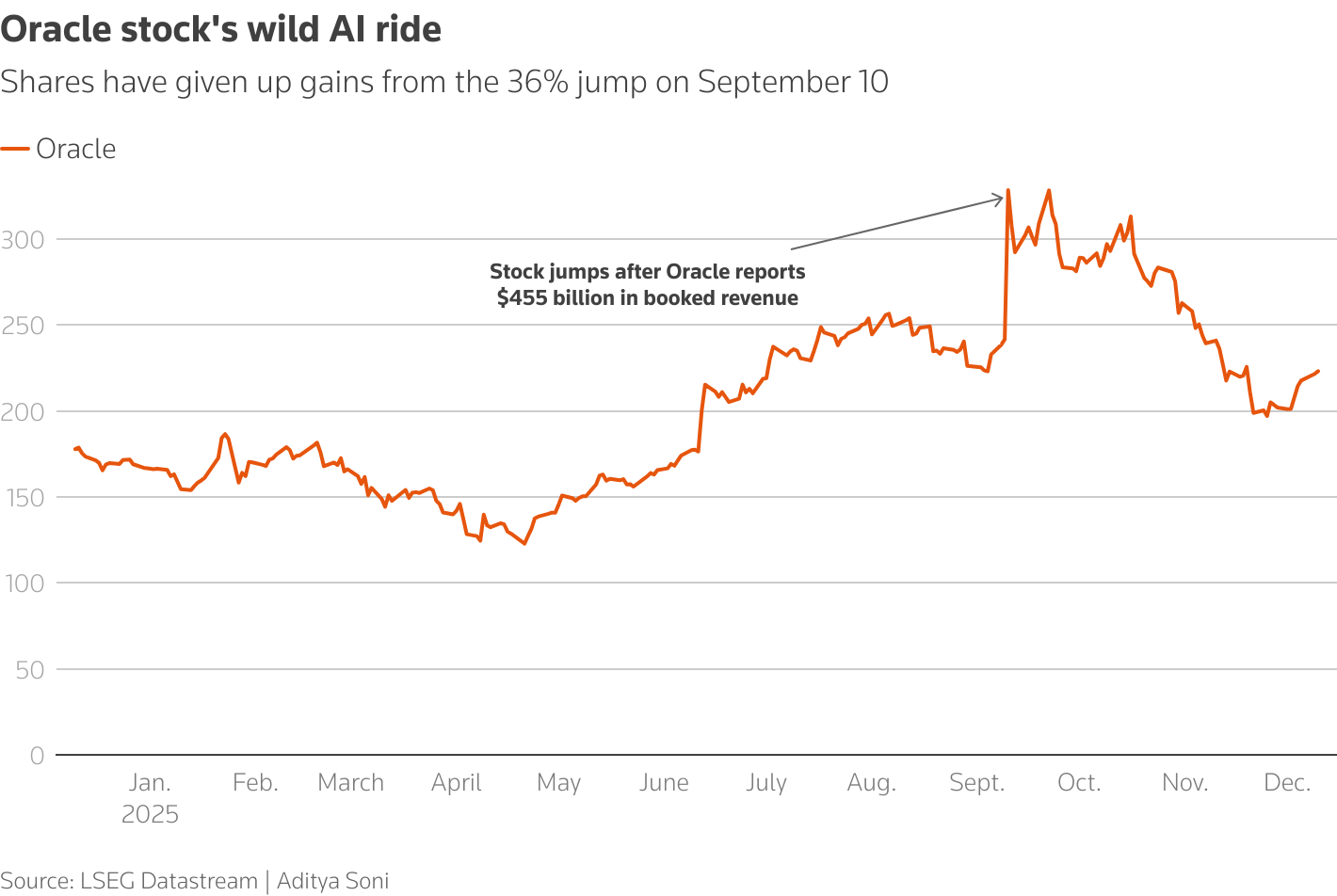

The Tech Trouble: Oracle (ORCL) recently missed revenue estimates, reigniting fears about the return on investment for massive AI capital expenditures. When a bellwether like Oracle shows weakness, it drags down sentiment for the entire tech sector.

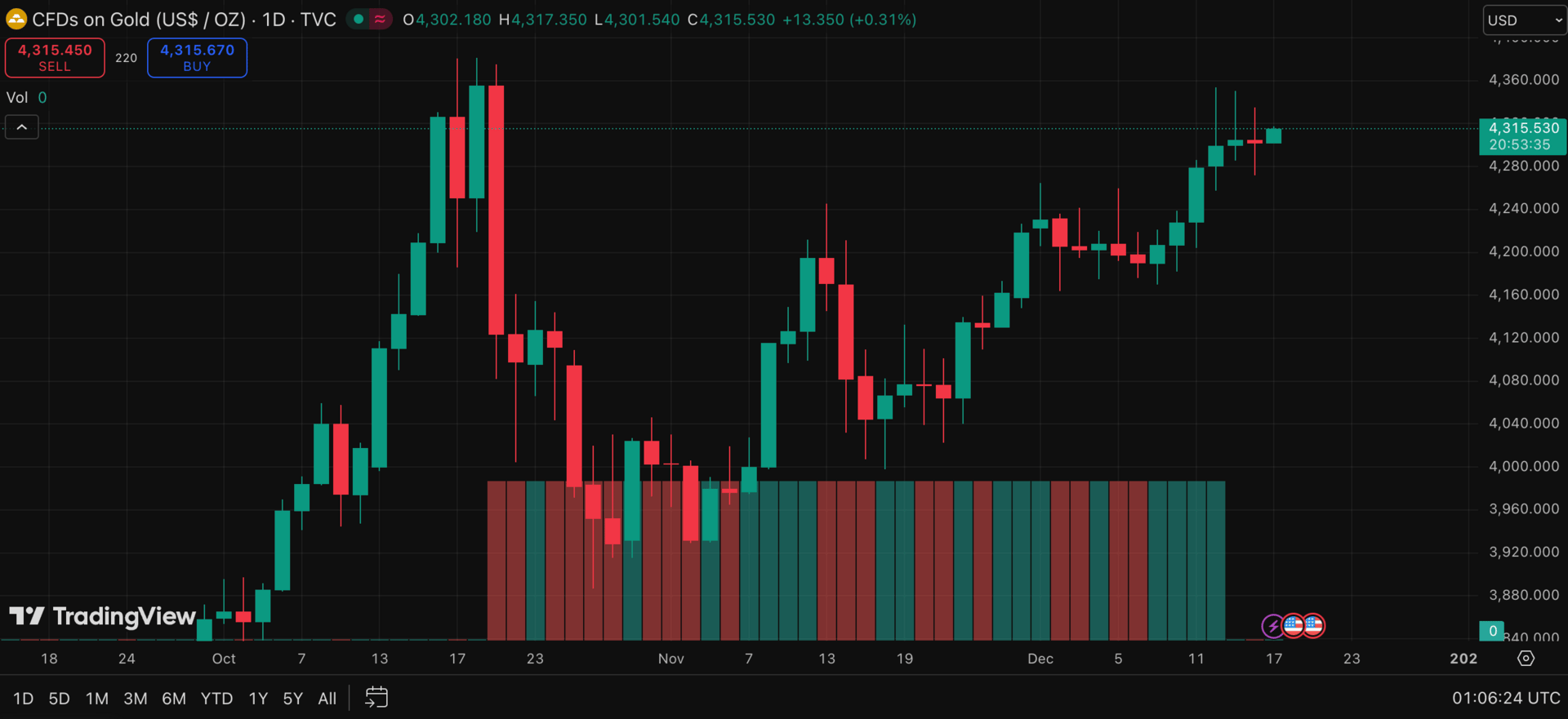

The Opportunity: Look away from the screens and look at hard assets.

Gold is poised to test its all-time high of $4,381, fuelled by a weaker dollar and risk-off sentiment.

Silver is having its second-best year on record, up roughly +110% in 2025.

Quant X Insight: When equity correlation spikes and tech falters, diversification into commodities isn't just "safe", it's often the highest alpha play on the board.

🧠 The Strategy: Don't Front Run Santa

The mistake retail traders make is buying early hoping for a bailout. The "Quant" approach is to wait for confirmation.

We are currently in a "middle-of-the-month" lull where seasonal odds actually point to a down market until just before Christmas. This is often driven by tax-loss harvesting, where investors sell losers to offset gains.

Your Move:

Watch the VIX: If volatility spikes, use it to enter premium-selling strategies (like Iron Condors) rather than directional bets.

Wait for the Window: Don't aggressively leverage long positions until we enter the statistical "Santa" window (final 5 trading days).

Respect the Trend: If Silver and Gold are the only assets breaking highs, don't force trades in struggling tech stocks just because they "look cheap."

🔑 Key Takeaway

The Santa Rally isn't a guarantee; it's a probability. While history favors a year-end push, the current macro headwinds (Fed hawkishness and tech earnings misses) demand caution. Stop trying to predict if the rally will happen. Instead, build a strategy that profits whether we get coal or cash.

Data beats hope. Every single time.

🚀 Join the Final 2025 Quant X Accelerator Masterclass

What if you could be the first to uncover the next trend or strategy before the 2026 open?

In the 90 minutes live class, we will walk through:

✅ 3 Quant X Models: Identifying leverage danger zones before they wipe out your portfolio.

✅ Beyond the Hype: How we extract real edge from the market

✅ Systematic Execution: How to build repeatable, emotion-free systems that withstand stress events.

To your growth,

The Quant X Team

Where Data Becomes Alpha

Editor: Si Min

Disclaimer: The views shared here are for educational purposes only and reflect our team’s opinions. They should not be taken as financial, investment, or legal advice. Please do your own due diligence before making any financial decisions.