Dear Tribe,

In the 1950s, a quiet physicist from Texas wrote a paper that would change how the world bets from blackjack tables to billion-dollar hedge funds.

John L. Kelly Jr. wasn’t a gambler. He didn’t even like casinos. But his obsession with Claude Shannon’s information theory led him to a radical insight: if you can measure information through noise, you can measure how money grows through uncertainty.

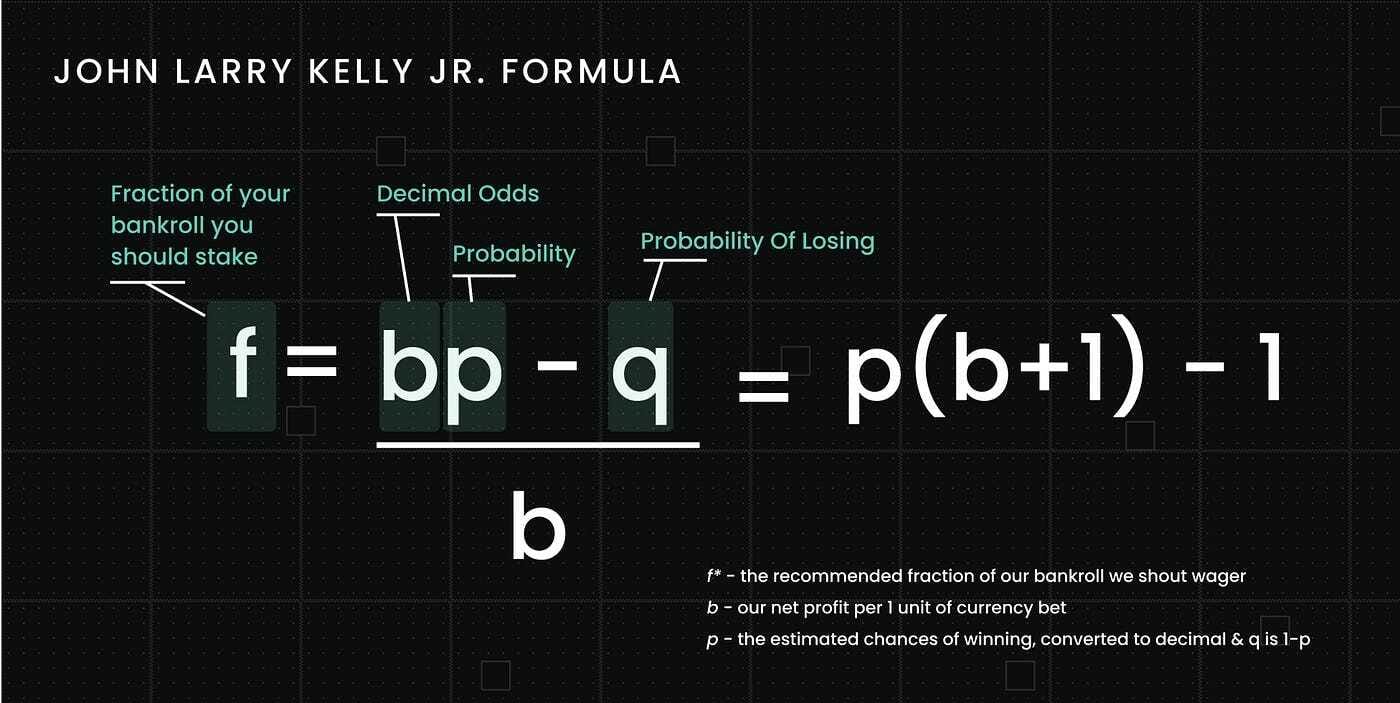

That single idea became the Kelly Criterion — the mathematical backbone of every serious trading strategy that manages risk like a science, not a vibe.

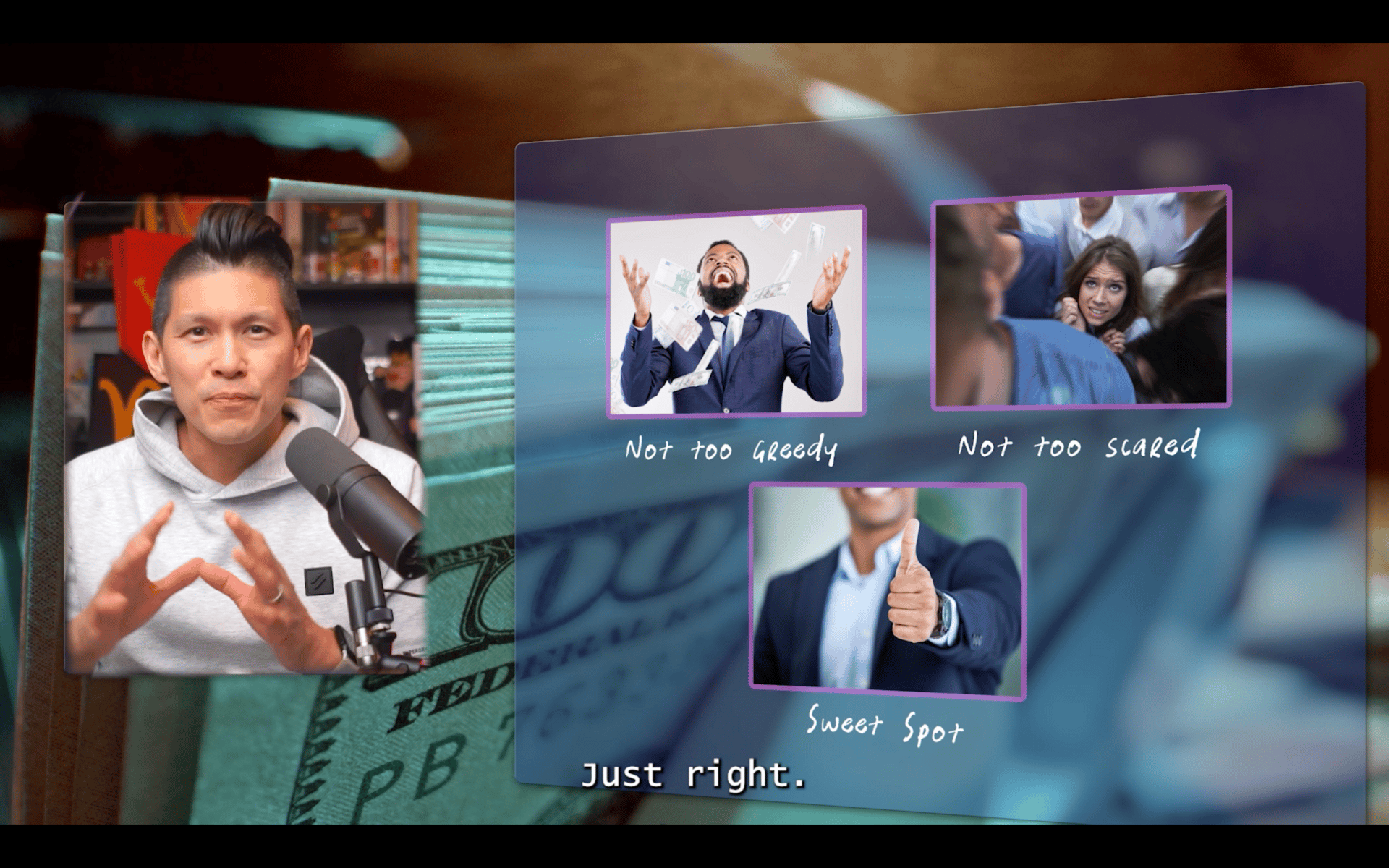

Before long, the formula left the lab and hit the casino floors. Mathematicians like Claude Shannon and Ed Thorp tested it in Reno and doubled their bankroll in 30 hours. Their secret? Bet just the right amount every time. Not too little, not too much. Just optimal.

Fast-forward to today: from Warren Buffett to Renaissance Technologies, the same principle runs deep in the DNA of quant investing.

Edge × Sizing × Discipline — that’s the holy trinity.

Kelly’s story has everything: gamblers, mobsters, unicycles and the birth of mathematical risk management. More importantly, it holds a timeless lesson: you don’t need to gamble to win big — you just need to size your bets like a physicist.

Want to learn how the Kelly Criterion can help you size risk, compound smarter and trade like a physicist?

🎥 Watch the full story on Quant X YouTube - The Secret Formula That Made Gamblers and Hedge Funds Rich

🔔 Subscribe to our channel for weekly data-driven breakdowns.

Or join our Quant X Community — where we read markets through math and data.

Team Quant X

Backtest. Optimise. Trade.

Disclaimer:

The views shared here are for educational purposes only and reflect our team’s opinions. They should not be taken as financial, investment, or legal advice. Please do your own due diligence before making any financial decisions.