Hi Investors,

I wanted to share the backtest results on a seasonal ETF rotation model that was originally developed by friends of mine.

This strategy systematically rotates exposure across a curated basket of ETFs such as IGV (Tech Software), ITA (Aerospace & Defense), GSG (Commodities), GUNR (Global Natural Resources), TQQQ (Leveraged Nasdaq), and others — all based on predefined seasonal entry and exit windows throughout the calendar year.

Each trade is fully scheduled in advance, with entries at 9:35 AM and exits at 3:45 PM, using position allocations between 0.4× to 1.0× of total portfolio value depending on conviction levels and historical drawdown patterns.

This setup ensures a systematic, rules-based approach that eliminates emotional decision-making and allows us to test repeatable seasonal patterns across sectors.

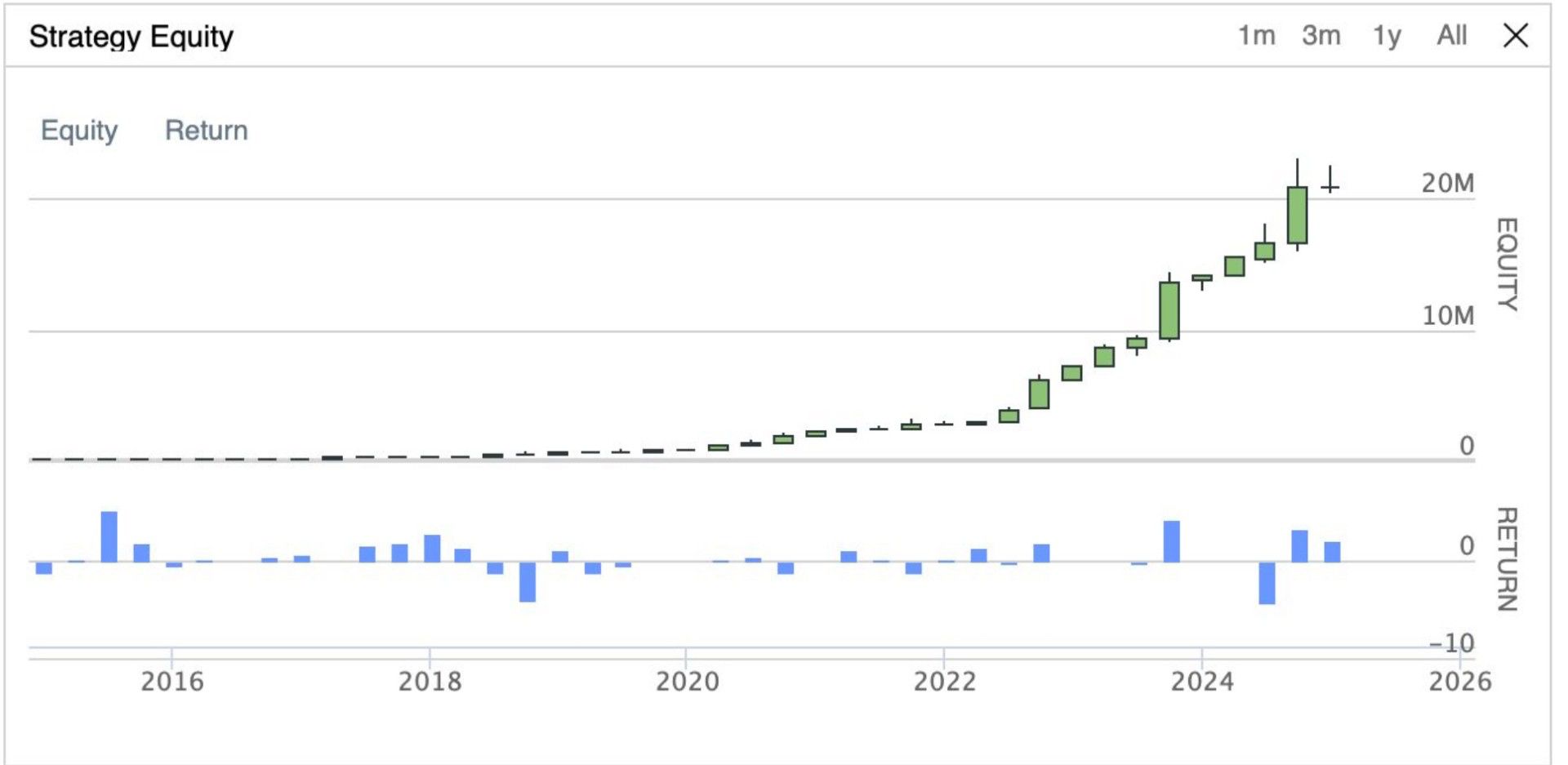

Results of Backtest period: 2015 → 2025

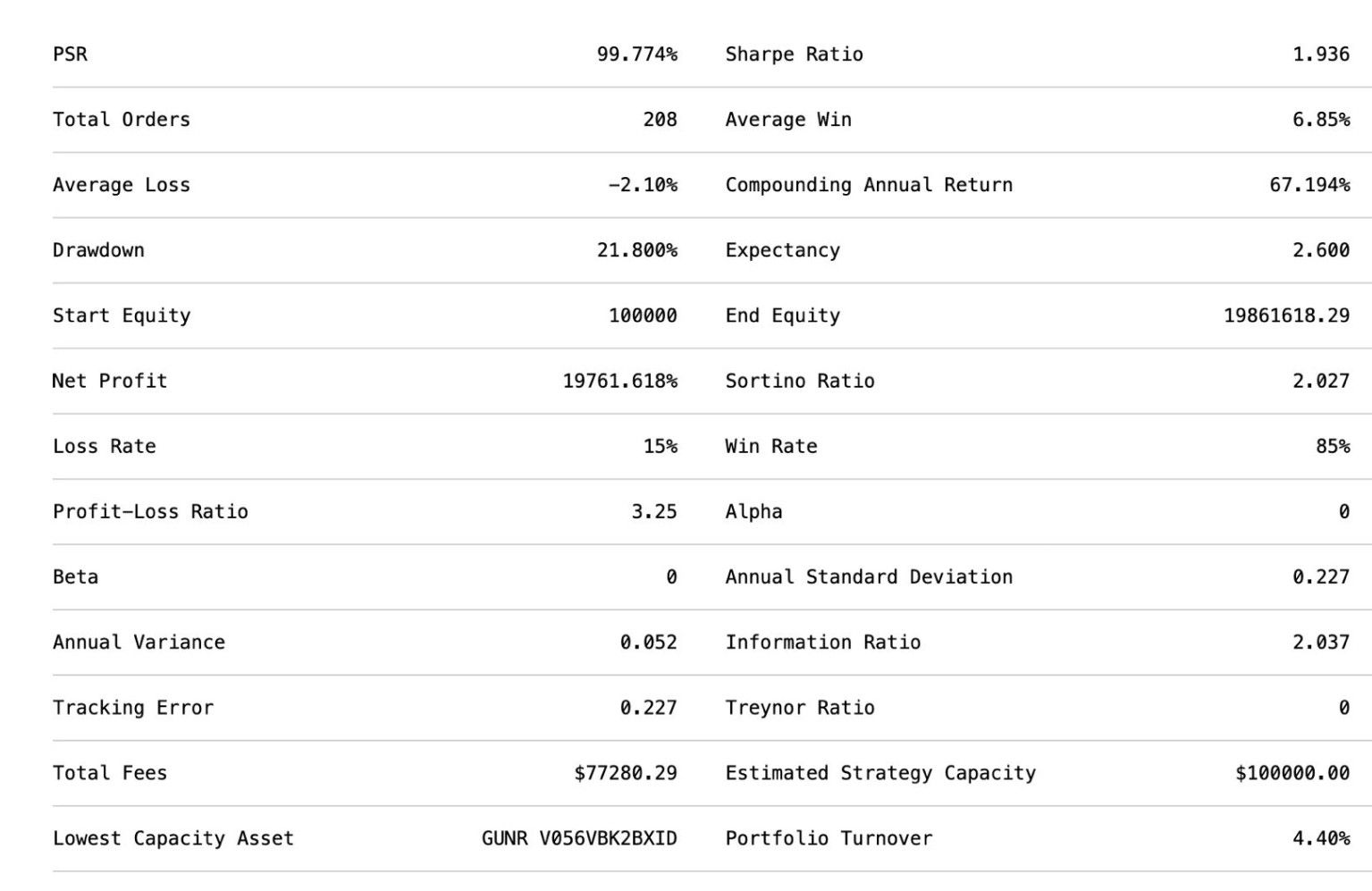

Performance metrics:

Sharpe Ratio: 1.94

CAGR: 67.19 %

Max Drawdown: 21.8 %

Win Rate: 85 %

For information, this model had been tested in various time frames and under environment that is simulated to be realistic which includes slippages and fees.

These backtest results suggests that simple calendar-based rotations can possibly deliver alpha over time.

Data is King, Sizing is Everything.

— Sean Seah

Portfolio Manager

Swiss-Asia Financial Services

Alpha Quant Index

---

Disclaimer:

The views shared in this message are strictly for educational purposes and reflect my personal opinions. They should not be construed as financial, investment, or legal advice. Always perform your own due diligence before making any financial decisions