Hello Quantx,

The Fed has just cut interest rates by 25 basis points to 4.00%–4.25%. It’s the first cut of 2025, and Chair Powell made it clear:

“There are no risk-free paths now.”

He pointed to slowing job growth and rising employment risks, even while inflation remains above target.

Whenever the Fed pivots like this, the obvious question comes up:

“What usually happens to markets after the first rate cut?”

Why we care about the “first cut”

The first cut is powerful because it signals a turning point in policy. Rates had been on hold for months, and now the Fed is taking action. Historically, this has often been a catalyst for equities—but the impact depends on whether the cut is made:

During a recession (to cushion the downturn), or

As an “insurance cut” (to support growth before the economy stalls).

What studies show

Looking across past cycles:

On average, equities rise in the 6–12 months following the start of a rate-cutting cycle.

Insurance cuts (growth slowdown, no recession) tend to deliver steadier gains, while recessionary cuts bring more volatility but sometimes larger eventual upside.

Surprises matter: the more unexpected the cut, the bigger the short-term reaction.

Rate-sensitive areas like small caps usually move first. Tech often becomes the big winner later on.

Here’s my own test…

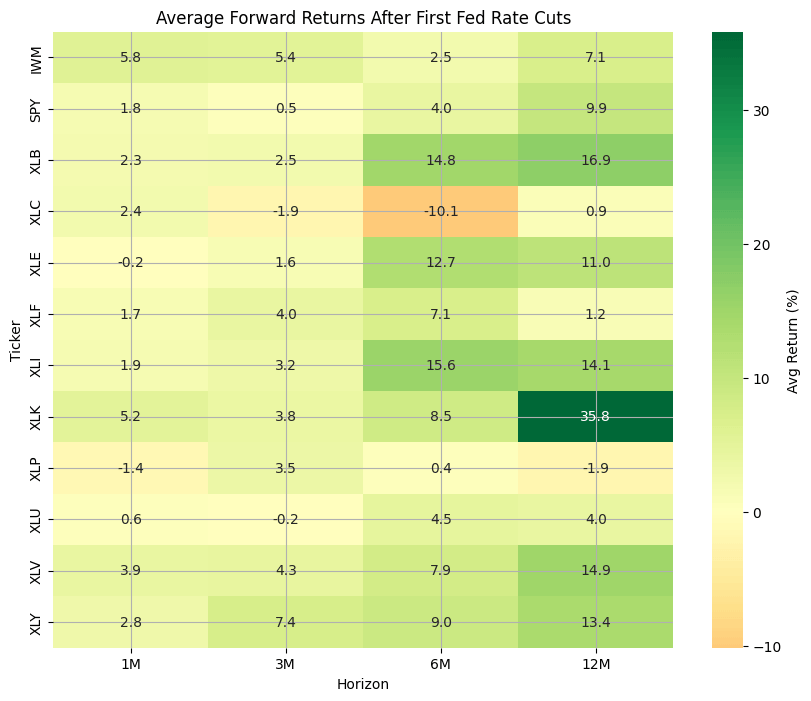

Instead of relying only on theory, I dug into the data myself:

Fed Funds history back to 1979.

Each “first cut” flagged in a new easing cycle.

Pulled S&P 500 (SPY), small caps (IWM), and sector ETFs.

Measured average returns 1, 3, 6, and 12 months later.

This means each number below is not a single episode, but an average across all first-cut cycles where data was available (roughly a dozen events since 1979).

What the numbers say

📈 Broad markets

S&P 500 (SPY): +1.8% (1M), +4.0% (6M), +9.9% (12M)

Small Caps (IWM): +5.8% (1M), +5.4% (3M), +7.1% (12M)

Takeaway: Small caps tend to jump faster in the first 1–3 months, while the S&P builds momentum over the year.

📊 Sectors (12-month average forward returns)

Tech (XLK): +35.8%

Industrials (XLI): +14.1%

Materials (XLB): +16.9%

Healthcare (XLV): +14.9%

Consumer Discretionary (XLY): +13.4%

Energy (XLE): +11.0%

These numbers are 12-month averages across all cycles since 1979 — e.g., Tech’s +35.8% means that, one year after the first cut, Tech averaged a gain of 35.8% across all instances.

Laggards (12-month averages)

Consumer Staples (XLP): –1.9%

Utilities (XLU): +4.0%

Communication Services (XLC): +0.9%

In contrast, defensives don’t provide the cushion investors often expect after a Fed pivot.

So what now?

History doesn’t repeat perfectly, but it rhymes. Based on past cycles, here’s what tends to play out:

Upside skew in the next 6–12 months, but with wide dispersion.

Small caps and cyclicals often pop first.

Tech compounds later as easing progresses.

Defensives may lag, even when volatility is high.

Of course, this isn’t a roadmap—it’s a set of probabilities. That’s why I continue to size risk carefully and let the data lead decisions.

My take

The Fed’s move tells us they’re worried about jobs, but not fully comfortable with inflation yet. If the slowdown doesn’t deepen into recession, history suggests this cut could set up a constructive 12-month window for equities. Still, risk management matters more than predictions.

Disclaimer

The views shared here are for educational purposes only and reflect my personal opinions. They should not be taken as financial, investment, or legal advice. Please do your own due diligence before making any financial decisions.

Data is King, Sizing is Everything

Sean Seah

Portfolio Manager, Swiss-Asia Financial Services

Alpha Quant Index